PNB E-GST Express Loan Scheme details| How to Apply PNB E-GST Express Loan | Eligibility Criteria for E-GST Express Loan in PNB | Step by Step Guide for PNB E-GST Express Loan

Introduction to PNB E-GST Express Loan:

Country’s second largest bank PNB has launched a special offer for their MSME customers who can now avail their GST express loan online sitting at the comfort of their home/ office.

The GST rollover all over the country was a great landmark in the history of Indian Economy and it has enhanced ease of doing business, greater productivity, efficiency and tax compliances.

Most of the MSME’s have already adopted GST system and filing their returns through GST portals.

Purpose of Loan: To provide hassle free credit to meet working capital requirements related to business activity or for expansion of business.

Eligibility to apply for PNB E-GST Express Loan:

- GST registered units which have filed GST returns atleast for the last 12months.

- Business entities having an active current account with us since past 12 months.

- Individuals,firms,companies, limited liability partnership and not availing working capital facility from any Bank/FI.

- GST exempted category & composite GST borrowers are not eligible.

- Commerical CIBIL upto CMR-5 including no CMR rank is acceptable.

- Minimum required SME SCORE for loan eligibility is above 52.

- Acceptable CIC score should be:

680&above.

No History.

- Udyam Registration Is mandatory.

How to apply for PNB E-GST Express Loan

:

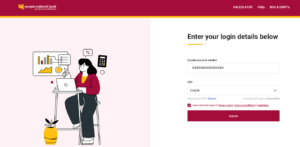

Step1.Customer will visit the PNB website www.pnbinida.in or PNBONE app or PNB netbanking for applying e-GSTExpress.

Step2.Customer will be asked to enter current account number and get verified with OTP.

Step3.After verification via OTP , customer will be asked to select GSTIN Number if multiple GSTIN number reflects.

Step4.Customer confirms business and promoters details by clicking on “proceed”.

Step5. Customer will be asked to give CIC consent for CIC generation and deduction of charges. Click the check box and click on “Proceed”.

Step6. After generation of CIC , customer will be asked to complete GSTIN details and get verified with OTP.

Step7.After the validation of GSTIN, sales and purchase of the customer will be reflected.

Step8. On clicking on the proceed button, customer will get the offer and he can change the loan amount by selecting the slider and click on proceed.

Step9.After selecting the loan amount, customer will get ‘Key Fact Statement’ with all the charges and other disclosures. Click the check box and click on “Proceed”.

Step10. After acceptance of Key facts statement, Congratulations page will reflect where message will be displayed that“application has been successfully sent to your branch for further verification”.

Step11. Borrower will get the SMS in their registered mobile number and registered e-mail ID for sanction/ rejection of loan and advised to continue the journey by clicking on the link mentioned in SMS/e-mail.

Step12. Final KFS will be displayed for acceptance. Now tick on the check box & click on Proceed.

Step13.After clicking on“ proceed to e-sign”, system will display the agreement & other details in “Agreement Preview ” section. Then click on “I agree” button. Borrower will be redirected to NeSL page for document execution.

Step14. E-stamping screen will appear. Customer needs to provide e-sign consent, and click on“e-sign”.

Step15. Customer will give consent on this screen for Aadhaar authentication, provide Aadhaar number and validate with OTP.

Step16.On the next screen, a congratulation page along with account number would be displayed and documents can be downloaded by clicking on “Download Document”.

Loan Amount:

Loan amount will be from 10 Lakhs to 100 Lakhs depending upon the customer’s requirement and eligibility.

Security:

Hypothecation of assets created out of the Bank finance along with entire current assets and non-current assets (Present & Future) of the unit shall be ensured.

The product will help customers to get loan amount conveniently and hassle free loan upto 1 Crores.

If you want to open current account online in PNB you may visit the link for Online Opening of Current Account.

Must Read: SBI E-Mudra PM Svanidhi how to apply, crieteria, amount and other details

2 thoughts on “PNB E-GST Express Loan Scheme – 2023| Important things to know”